Main Content

Visa EB - 5 Investor

Program

Visa EB-5 Investor Program

Invest in America Real Estate

EB-5 = a bridge for future opportunities

frequently asked question (faq)

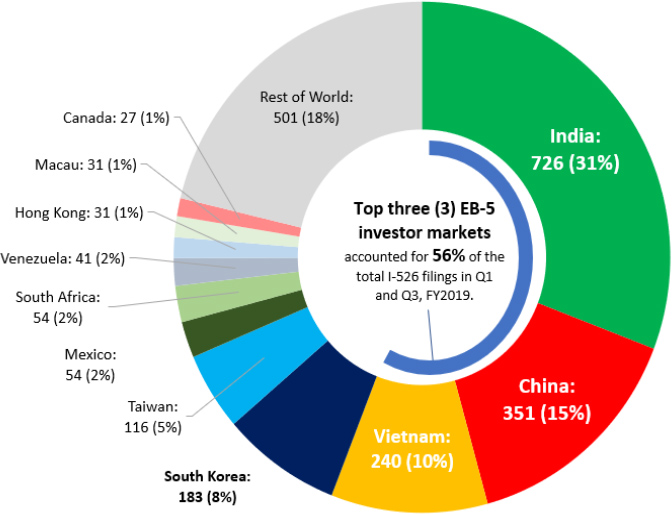

Number and Percentage of I - 526 Filings By EB-5 Investor Market

(Q1+Q3 FY 2019)

Investor Program?

10,000 visas are available for individuals who make an investment in a new commercial enterprise (NCE).

4,000 Visas are set aside for projects in RURAL areas.

Applicants (and immediate family members) can become permanent residents of the US within 6 – 12 months.

Immigrant Investor

Program established?

Established in 1993 to increase investment through the EB-5 Program, the US Congress introduces the ‘temporary’ Immigration Investor Pilot Program (also known as the Regional Center).

The Program reauthorized on March 11th 2022 by US Congress, US Senate and the President Joe Biden signed into Law.

Basic Requirements

That is exactly what you get here. This website has been built with you in mind. From the highest quality property images to the most informative guides and blogs, she is here to make your home buying or selling experience smooth and stress-free.

Whether it's buying, selling or simply learning more about your real estate investment, Aaron Kirman and his team have the expertise to get you started.

Built-in cabinets and countertops offer functionality and storage in the home’s country kitchen. The home also features an outdoor living area, complete with a pool, a snack bar, and a fireplace.

Current Projects

Completed Projects

Upcoming Events

January 15-16, 2024 @ 5:00 pm - 7:00 pm

Newport Beach, California

We Provide – Real estate investment opportunities in the US west coast marketplace. We Bring – EB-5 investors together with legal professionals to obtain green cards. We Insure – That the development projects get built and comply with USCIS requirements.

Who We Are

Deliver superior EB-5 projects for foreign nationals to obtain green cards.

Promote economic growth.

Establish a multicultural community.

Focus on real estate development projects.

• We Provide – Real estate investment opportunities in the US west coast marketplace.

• We Bring – EB-5 investors together with legal professionals to obtain green cards.

• We Insure – That the development projects get built and comply with USCIS requirements.

• A fast process for qualified Foreign Investors and their families to obtain a “Green Card”

• No need to create your own business

• Return your investment in 5 years

• Investment through our Licensed Regional Center

• Must prove legitimate source of funds for the investment

• Investors can live anywhere in the United States

• Investor, spouse and children under 21 years of age are eligible to receive the green card

• Service & Dedication: All our services are focused individually on each investor coupled with dedication and particularly to the needs and objectives of each investor

Frequently Asked Questions

In 1990, under section 203(b)(5) of the Immigration and Nationality Act (INA), 8 U.S.C. §1153(b)(5) the US Congress created the fifth employment-based preference (EB-5) immigrant visa category. Each year, the provision grants 10,000 immigrant visas to qualified individuals seeking permanent resident status on the basis that their investment in a new commercial enterprise that will benefit the US economy.

In 1990, under section 203(b)(5) of the Immigration and Nationality Act (INA), 8 U.S.C. §1153(b)(5) the US Congress created the fifth employment-based preference (EB-5) immigrant visa category. Each year, the provision grants 10,000 immigrant visas to qualified individuals seeking permanent resident status on the basis that their investment in a new commercial enterprise that will benefit the US economy.

In 1990, under section 203(b)(5) of the Immigration and Nationality Act (INA), 8 U.S.C. §1153(b)(5) the US Congress created the fifth employment-based preference (EB-5) immigrant visa category. Each year, the provision grants 10,000 immigrant visas to qualified individuals seeking permanent resident status on the basis that their investment in a new commercial enterprise that will benefit the US economy.

In 1990, under section 203(b)(5) of the Immigration and Nationality Act (INA), 8 U.S.C. §1153(b)(5) the US Congress created the fifth employment-based preference (EB-5) immigrant visa category. Each year, the provision grants 10,000 immigrant visas to qualified individuals seeking permanent resident status on the basis that their investment in a new commercial enterprise that will benefit the US economy.